A New Venture Financing Model

There is a fundamental shift in venture capital from a "growth-at-all-costs" software model to a more disciplined, asset-heavy approach focused on sectors like AI infrastructure, energy, and defense. We argue that today’s most consequential companies are grounded in real-world physics and capital intensity, requiring investors to adopt the rigor of project finance to build durable value. Ultimately, venture is evolving by using sophisticated capital structures to underwrite growth where tangible assets and cash durability are the primary competitive advantages.

Warrants and Covenants in Venture

Most founders focus on valuation, but in later-stage venture rounds the real shift happens in the terms. Warrants and covenants change how upside, risk, and decision-making are allocated once checks get larger and timelines tighten. Understanding them is the difference between raising growth capital and accepting structures that constrain flexibility and dilute outcomes over time.

The Preferred Rights That Matter Most, and How They Shape a Founder’s Fate

Founders often over-index on simple valuation metrics while ignoring the complex "legal DNA" of preferred rights, which ultimately dictate the distribution of control and economics. Because these terms compound across funding rounds, early concessions in seed rounds create a permanent, structural baseline that can drastically reshape a founder’s control and payout at exit.

Ventures Edge Predictions for 2026

2026 is shaping up as a turning point where AI shifts from a standalone product to a layer embedded across products, workflows, and the physical world. As adoption accelerates, compute and energy constraints move from IT concerns to strategic bottlenecks that shape what can scale. At the same time, macro forces like regulation, geopolitics, and cultural backlash increasingly determine where companies build, how they operate, and who wins.

Enterprise SaaS is Changing

Internal AI agents and collapsing software development costs are eroding the traditional moat of enterprise SaaS as intelligence shifts inward. As externally packaged software becomes infrastructure rather than the primary source of differentiation, public markets are repricing incumbents around weaker growth and pricing power. The real value is moving to whoever controls the internal intelligence and orchestration layer that sits on top of enterprise systems.

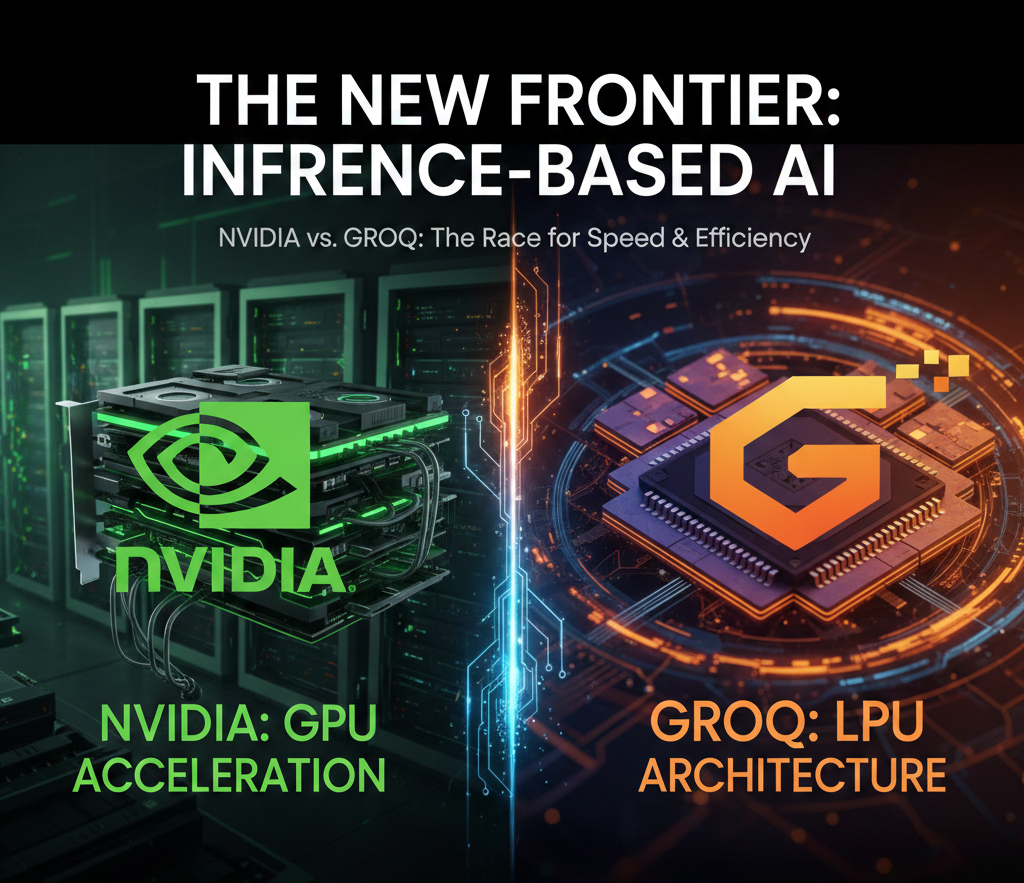

A $20B Signal About Where AI Infrastructure Is Actually Going

NVIDIA’s $20 billion deal with Groq marks a pivotal shift in AI infrastructure, moving the focus from model training to large-scale inference efficiency. Rather than a traditional acquisition, NVIDIA executed a "strategic intervention" by licensing Groq’s core technology and absorbing its top engineering talent, including founder Jonathan Ross. This "reverse acqui-hire" allows NVIDIA to bypass lengthy antitrust reviews while effectively neutralizing an architectural rival. By integrating Groq’s ultra-low-latency Language Processing Units (LPUs), NVIDIA is positioning itself to own the next phase of the AI boom, where the value is measured not by how models are built, but by the speed and cost of how they are delivered to users.

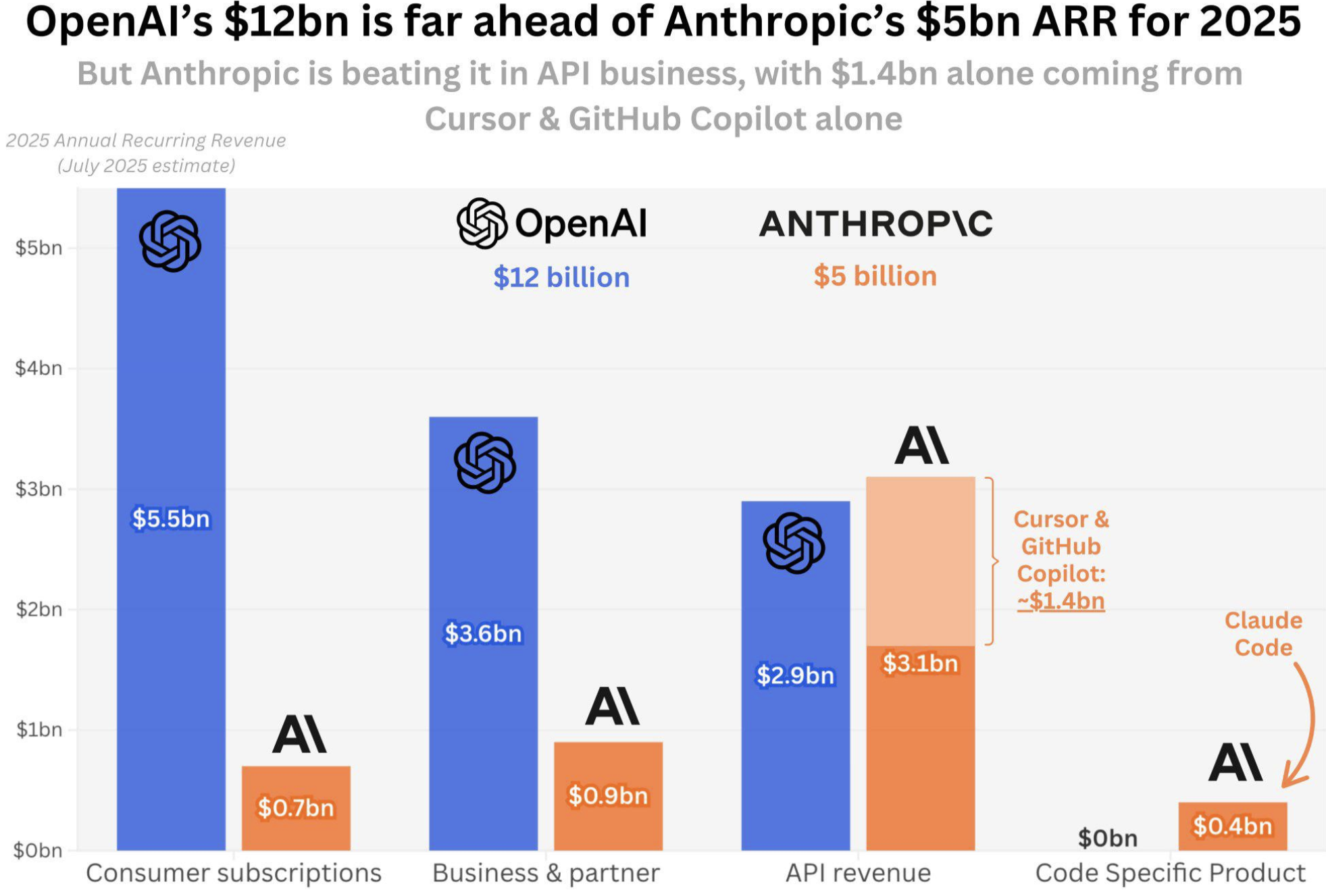

OpenAI’s Code Red

OpenAI’s code red is less about falling behind technically and more about recognizing that momentum has shifted. As foundation models converge, advantage increasingly comes from distribution, trust, and integration rather than raw benchmark performance. Google and Anthropic are gaining ground not by being first, but by being embedded where users and enterprises already operate, exposing how fragile first mover advantage can be in fast-diffusing markets

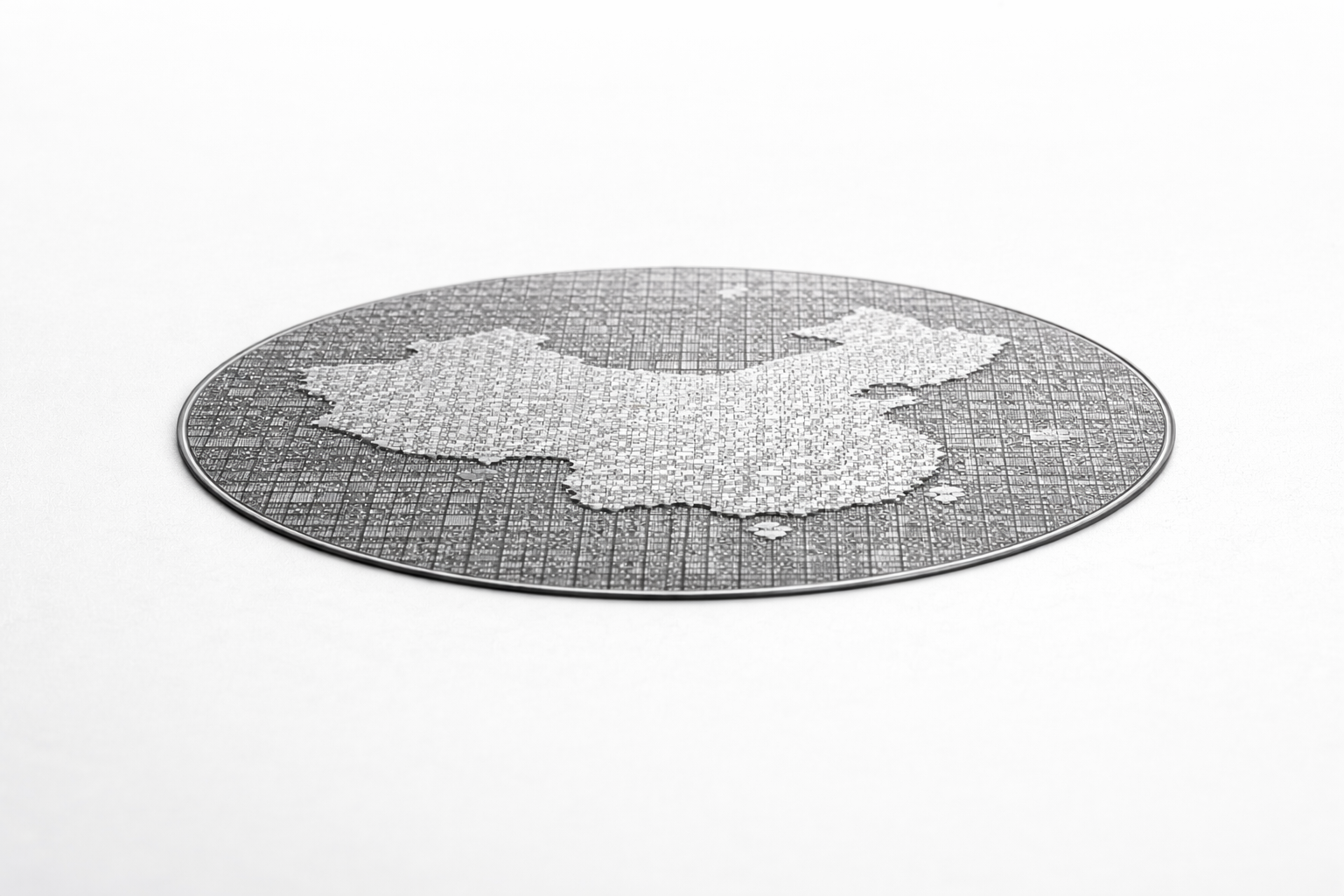

China’s EUV Breakthrough

For most of the last decade, discussions about artificial intelligence have focused on models, talent, and data. Yet in late 2025, a different story began to reshape that narrative. China has reportedly built a prototype extreme ultraviolet lithography machine, the most critical industrial tool for producing the world’s most advanced semiconductors.

Software & Silicon

NVIDIA’s real advantage isn’t the GPU, it’s CUDA: a vertically integrated software stack that turns theoretical FLOPs into real, high-utilization performance and continuously improves throughput, latency, and scaling via software alone. In AI inference, CUDA is what drives tokens per watt-dollar down over time, making NVIDIA hardware economically defensible while rivals with similar silicon fall behind.

Made in China

Day by day, it is becoming abundantly clear that the AI models powering Western companies are no longer the ones made in the West. That reality has slipped in almost unnoticed. While the public conversation circles around frontier labs and safety debates, engineers inside North American companies are quietly building on Chinese open-source systems like Qwen, DeepSeek, Yi, and Kimi. They are doing it for one simple reason: these models deliver what they need at a price they can afford.

How Google Is Competing in the AI Compute Race

Google is scaling its TPU strategy, offering a cost-efficient alternative to Nvidia that is gaining traction across major AI developers. Gemini-powered search continues to grow, supported by Google’s TPU-backed infrastructure. The broader market is moving toward multiple winners as Google, Anthropic, OpenAI and Nvidia each secure advantages in different parts of the AI ecosystem.